Interview: Pandemic response drives Industry 4.0 at Limerick

Leo McHugh, vice president for industrial automation for Analog Devices, based in Limerick, Ireland, talks to Nick Flaherty about expanding its European fab and the continuing impact of the Covid-19 pandemic in many ways.

“This is going to be a golden age for industrial with the digitalisation and the rejuvenation of manufacturing and we need to gear up for that so we need to increase our output by a significant amount this year and into FY24 and FY25,” he said.

- Analog Devices reports strong financial results

- Analog Devices to invest €100m in Limerick R&D centre

- Intel, ADI in US chip alliance

This is down to two key industry trends.

Leo McHugh, VP of Industrial Automation at Analog Devices

“For me there were two resounding themes this year,” he said. “One is sustainability and the other is resilience. I can’t put those into two different parts. The resilience is a result of what’s been happening over the last two or three years and an acknowledgement that there are a lot of bottlenecks in the supply chains and the manufacturing itself.”

The shutdowns during the pandemic highlighted the vulnerability of the supply chain and is driving a lot more automation, which is boosting demand for sensors and industrial networking, This was a key factor in ADI’s strong results last month.

“I think this now is the impetus Industry 4.0 really needs to take off,” said McHugh. “There is a lot of focus on ‘how do we really get an efficient, productive enterprise’ and that is leading to a lot of the digital transformation that we talk about. This is things like edge processing, AI at the edge, a lot more sensorisation and data and some of that data is coming back to enterprise control.”

The convergence of factory systems with enterprise networks has been talked about for years but there are signs of that happening now, he says.

“On sustainability, what I see is that a lot of companies looking to invest in more resilience and edge processing are also looking at energy efficiency at the same time, upscaling the systems and machines to get us to a sustainable enterprise. I think the investment that is coming for resilience will have a knock on effect on the sustainability, but things take longer to ramp up in the industrial market,” he said.

- Analog Devices shows digital energy tech in Europe

- Analog Devices completes acquisition of Maxim Integrated

ADI has moved heavily into embedded machine learning following its acquisition of Maxim Integrated a year ago.

“When we talk about intelligence at the edge there is a tradeoff that you have to get right,” he said. “A lot of the edge devices will be power limited and perhaps battery powered so you need to trade off the power for interpreting data at the edge versus sending it back to the cloud. So for us its about the interpretation of the data locally, but that means you need a very power efficient processor. Through Maxim we have low power processors that are tuned to run AI at the edge, so the combination of the companies is getting a lot of traction.”

Motors are a key part of this.

“65% to 70% of electricity consumption in a factory is used in driving motors so that’s a huge contribution to global electricity usage. Get that down while the output goes up and productivity improves,” he said.

“Motor control is a traditional part of our business but now what’s happening is that motor control with the energy efficiency requirement we are adding AI and ML not just for energy but also for tuning the motors based on the learning from being in place. We acquired Trinamic for its big position in stepper motors and can reduce the energy consumption by about 75%. When you focus on larger AC-induction motors with ML that gets even more significant.

This applies to retrofitting existing motors as much as new designs.

“We are seeing an increased focus on both new motors, about 50m are installed every year, and there are close to 500m already installed,” he said “Some of the new applications such as Additive Manufacturing and 3D printing you need more linearisation and control of the motors and as that moves into medical, the precision that required, that’s our business.

This is driven by an increasing trend for localisation as a response to both the pandemic and climate emergency.

“Now the performance of a factory is not about economies of scale with a huge factory with a small product portfolio, Now with automation you have more digital factories where you can compete with a relatively small factory and that brings personalisation, shipping volumes of one.”

Supply chain shortages

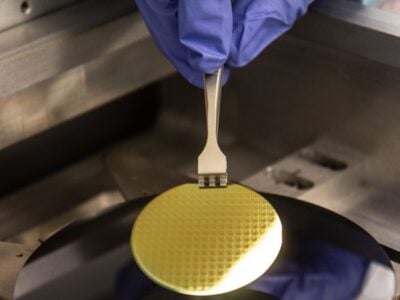

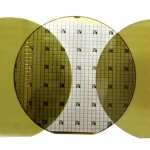

The company is still seeing chip shortages and increasing its capacity accordingly with investment in 200mm fabs in the US and Ireland.

“We have a shortage but we work closely with customers to figure out how much they need per week, per month, rather than taking an order of 500 or 1000, so we keep everyone up and running,” he said. “We’ve increased our output and we are seeing the benefit of that. Even through FY23 we will be increasing output even further,” he added. “It can be hand to mouth sometimes. It is still a constrained environment.”

This is down to demand exceeding supply, he says. “Our supply is up 40 to 50% compared to where it was. A lot of that is internal with the feature rich nodes, and we’ve always had a strategy of bringing those internal as the foundries move on. We are bringing up Beaverton in the US with a 0.18um process and the fab in Ireland,” he said.

“We had built the foundations in 2019 [at the site in Limerick] and that has now been kitted out. We have about 50% of it up and running and we expect that to be up to 100% in the next six months fully kitted out. The lead time for the equipment is long and that’s why only some of it is up and running now.”

“It’s a continuation of what we do at 0.25, 0.35um for customers that want parts for 20 or 30 years. These systems are still growing,“ he said.

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News