Chip demand holding up according to top foundaries

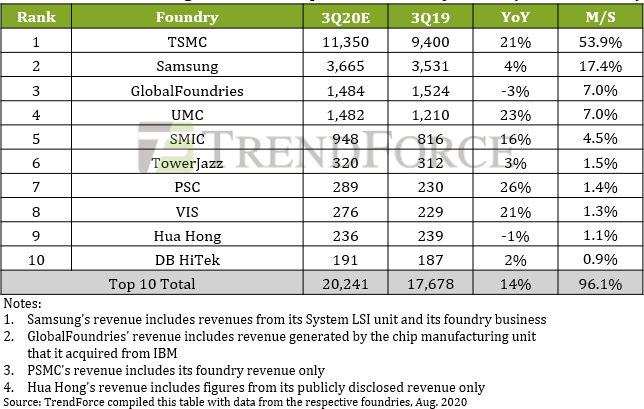

TSMC’s volume production of 7nm technology and introduction of 5nm production is set to grow 21 percent although its much smaller rival United Microelectronics is set to post a 23 percent annual increase. The fastest growing foundry in 3Q20 will be Power Semiconductor Corp. (PSC) with 26 percent.

As market and technology leader TSMC has been able to maintain capacity utilization due to strong demand for 5G infrastructure build out and CPU/GPU demand for high performance computing and work-from-home needs. And 5nm revenue is expected to start in 3Q20 with it accounting for 8 percent of its total annual revenue by the end of 2020. Trendforce estimates that 5nm will be responsible for 16 percent of TSMC’s 3Q20 revenue.

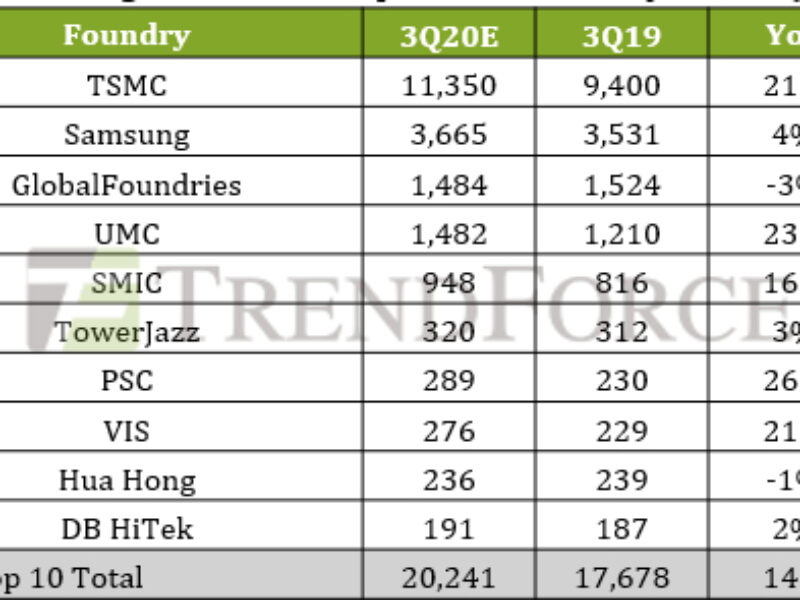

Ranking of top ten foundry suppliers by estimated revenue for 3Q20 in millions of dollars. Source: TrendForce.

Meanwhile Samsung has been forced to adjust wafer production to take into consideration declining sales of its flagship S20 series smartphones and need for Exynos applicaton processors. The foundry was supported by clients ordering strongly for fear of chip shortages due to supply chain breakdowns under the impact of Covid-19. The net result is Samsung’s foundry business is expected to achieve an annual increase in quarterly revenue of about 4 percent in 3Q20.

GlobalFoundries’ exposure to automotive market has hurt it and combined with the sale of 200mm and 300mm wafer fabs in 2019 means it is facing a revenue decline of 3 percent.

Demand for large display panels is keeping up sales of display driver ICs and PMICs and UMC’s 200mm wafer capacity is expected to remain in short supply until 2021. Trendforce says that UMC has taken the opportunity to raise prices on some of its foundry services.

However, TrendForce’s conclusion is that the foundry sector has benefitted from a period stock-piling due to Covid-19 uncertainty. Individual foundries will need to pay attention to exactly when customers begin to unwind their positions.

Related links and articles:

News articles:

- FIRST SEVEN CUSTOMERS FOR 5nm TSMC PRODUCTION

- NXP, TSMC TEAM ON 5nm AUTOMOTIVE PROCESS

- IN-CHIP SENSOR FABRIC MOVES TO 6nm

- 5nm ASIC DESIGNS START

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News